You’ve probably heard the term “Managed IT Services” thrown around a lot in the business industry, but what does it mean? Essentially, managed IT services companies in the USA and around the world are outsourcing providers who handle all or parts of a business’s IT systems. This can include everything from managing hardware and software to handling data centers and cloud services

Working with a managed IT service provider not only ensures that your IT systems are running smoothly, but it can also free up your internal staff to focus on more strategic tasks. Instead of worrying about routine maintenance or troubleshooting problems, you can trust your IT to experts who specialize in managing these systems

This kind of service is not a one-size-fits-all. It’s tailored to the specific needs of your business, whether you’re a small startup or a large corporation. Managed IT services companies in the USA are equipped to handle a wide range of IT needs, making them a versatile choice for businesses of all sizes and industries

Managed IT service providers are partners that work closely with your business to support and manage your IT infrastructure. They provide a wide range of services, including IT consulting, network management, data backup and recovery, cybersecurity, and cloud services, among others

By partnering with a managed IT service provider, you gain access to a team of IT professionals who are dedicated to keeping your systems running smoothly. This team not only includes technicians who can resolve technical issues, but also strategists who can help you plan for the future. They can help you understand the latest technology trends and determine how to leverage them to your advantage. Many businesses choose to work with managed IT service providers because they offer a high level of expertise at a fraction of the cost of maintaining an in-house IT department. By outsourcing your IT needs, you can save money while still ensuring that . .

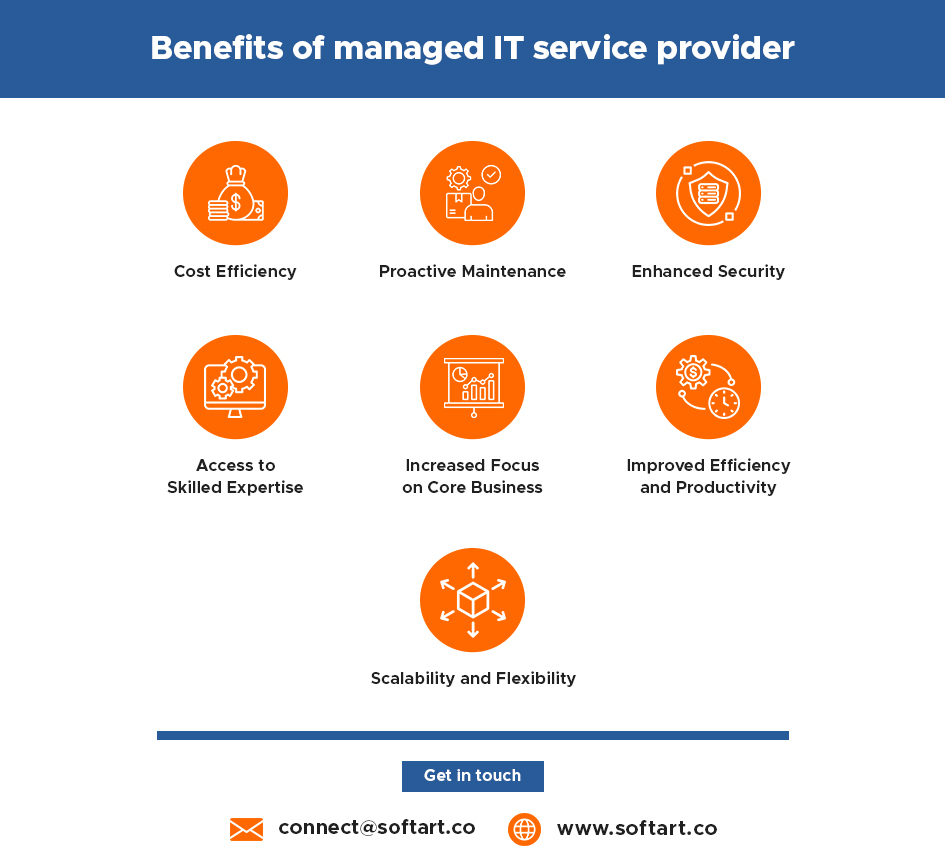

Managed IT services can benefit businesses in a variety of ways. Here, we’ll explore six key benefits that you can enjoy when you choose to work with managed IT services companies in the USA

By outsourcing your IT needs, you can avoid the expenses associated with hiring, training, and maintaining an in-house IT team. This can free up resources that you can then reinvest in other areas of your business

2. Managed IT services can improve efficiency & productivity

With a team of experts handling your IT, you can rest assured that your systems are running smoothly. This allows your employees to focus on their core responsibilities, rather than spending time troubleshooting IT issues.

3. Enhance security and compliance

Managed IT service providers are familiar with the latest cybersecurity threats and regulatory requirements, and they can help you implement the necessary measures to protect your business

4. Access to the latest technology

Managed IT service providers stay up-to-date with the latest IT trends and technologies, and they can help you leverage these to your advantage

5. Managed IT services offer scalability

As your business grows, your IT needs will likely change. Managed IT service providers can easily scale their services to meet your changing needs.

Finally, managed IT services can provide peace of mind. Knowing that your IT systems are in good hands can relieve stress and allow you to focus on running your business.

As your business grows, so too do your IT needs. Trying to manage this growth internally can be challenging, especially if you’re already stretched thin. This is where managed IT services come into play

Managed IT services companies in the USA can help you manage this growth by providing scalable solutions. Whether you’re adding new employees, expanding to new locations, or simply dealing with an increase in data, a managed IT service provider can easily adjust their services to meet your needs

The tech world is constantly evolving, and staying on top of these changes can be a full-time job. By partnering with a managed IT service provider, you can ensure that you’re leveraging the latest technologies to your advantage. These providers often have partnerships with top tech companies, including Oracle ERP service providers, that allow them to provide you with access to the latest tools and software.

Furthermore, managed IT services can also support business expansion by improving efficiency and productivity. With a team of experts managing your IT, your employees can focus on their core responsibilities. This can lead to increased productivity, which can in turn drive business growth.

If you’re ready to experience the benefits of managed IT services, SoftArt is here for you. As a leading managed IT service provider and Oracle ERP implementation partner, we have the expertise and resources to meet all your IT needs.

Our team of experts will work closely with you to understand your business and develop a customized IT strategy. Whether you need help managing your network, protecting your data, or implementing new software, we’ve got you covered.

Don’t let IT challenges hold your business back. Contact SoftArt today to learn more about our managed IT services and how they can help your business grow.

Are you tired of traditional accounting methods that leave you drowning in paperwork and struggling to keep up with your financial operations? It’s time to embrace the power of technology and revolutionize your business finances with NetSuite Cloud Accounting Software. The biggest influencers in purchasing ERP software were finance and accounting (23%) and IT department employees (23%). You can only imagine how helpful it would be if there was an ERP software that specifically supports financial accounting.

NetSuite has been a leading brand name in the ERP space for many years. With over 37,000 customers in 219 countries and territories around the world, they provide a full, cloud-based ERP suite. This also includes financials, inventory management, HR, professional services automation, and omnichannel commerce modules.

Let’s talk about how this groundbreaking software can transform your financial operations, the benefits of NetSuite accounting, and how Netsuite integration services can ultimately catapult your business toward success.

NetSuite is a cloud-based accounting software that offers a comprehensive suite of finance and accounting tools designed to streamline financial operations for businesses of all sizes. It is a robust solution that combines core financial management functionalities with industry-specific features, making it a versatile option for companies in various industries.

Cloud-based accounting software refers to any accounting program that is hosted on the internet rather than installed on a user’s computer. This means that users can access their financial data from anywhere with an internet connection, providing them with real-time visibility into their company’s finances.

NetSuite was founded in 1998 as one of the first cloud-based business software providers, and it has since become one of the market leaders in the industry. Throughout the years, NetSuite has established itself as a trusted solution for financial management and is known for the immense benefits of NetSuite accounting. You can harness the full potential of the software with the help of the right NetSuite integration partners.

Let’s talk further about the features

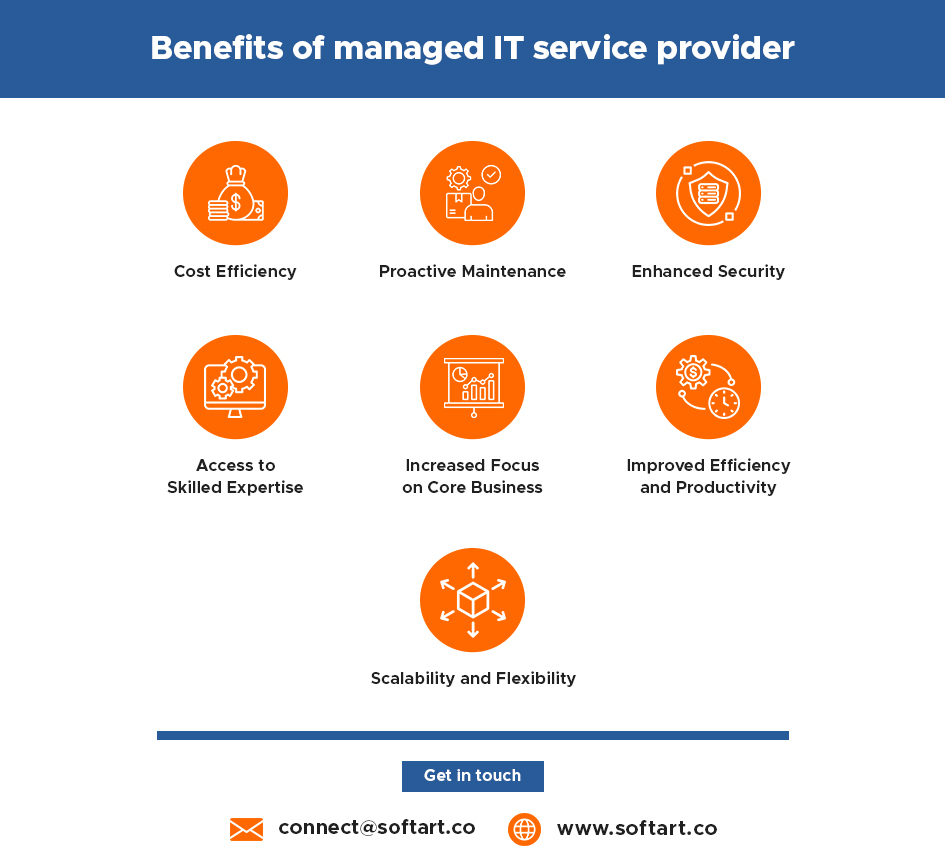

NetSuite Cloud Accounting Software comes with an array of key features designed to elevate your financial management:

Financial operations and management play a crucial role in the success and growth of any business. It involves various processes such as budgeting, forecasting, financial analysis, reporting, and bookkeeping to ensure that the company’s finances are stable and well-managed. Yet, many businesses struggle with effectively managing these operations due to outdated systems and manual processes and fail to realize the benefits of NetSuite accounting.

Overview of Financial Operations

Financial operations refer to all the activities involved in managing a company’s money flow. These include cash inflows (revenue) from sales or investments and outflows (expenses) for operating costs such as salaries, raw materials, etcetera. The goal of managing financial operations is to ensure that there is always enough capital available to cover expenses while also keeping an eye on profitability. The experienced NetSuite integration partners will always guide you through the same.

Overview of Financial Management

Financial management has a wider scope compared to financial operations, as it deals with strategizing long-term goals related to revenue generation while minimizing costs. This involves analyzing market trends, identifying potential risks or opportunities,

NetSuite is a popular cloud-based accounting software that has been gaining attention from businesses of all sizes in recent years. This powerful tool offers a range of benefits for financial operations, making it an ideal choice for companies looking to streamline their financial processes.

Here are the key benefits of using NetSuite for financial operations:

One of the biggest advantages of using NetSuite for financial operations is its real-time visibility and control features. With this software, you can access up-to-date financial information at any time, giving you a better understanding of your company’s overall financial health. This can help you make more informed decisions and identify potential issues before they become major problems.

NetSuite offers a wide range of functionalities designed specifically to streamline financial processes, making it easier to manage your finances efficiently. From automated invoicing and payment processing to bank reconciliation and budgeting, this software can handle all aspects of your financial operations seamlessly.

With NetSuite, you no longer have to worry about data inconsistency or duplication as all your financial data is stored in a centralized location. This means that all departments within your organization will have access to the same accurate and up-to-date information, reducing errors and improving overall efficiency.

Another significant benefit of using NetSuite for financial operations is its customizable reporting feature. The software allows you to create personalized reports with the specific metrics and KPIs that matter most to

NetSuite helps you generate comprehensive reports and leverage advanced analytics tools to gain deeper insights into financial performance, aiding strategic planning.

Cloud-based accessibility allows secure access to financial information from anywhere, promoting collaboration among teams irrespective of geographical location.

| Step | Description |

| 1. Assessment and Planning | Evaluate existing processes and define implementation goals. |

| 2. Team Formation | Create an implementation team and designate a project manager. |

| 3. Customization and Configuration | Customize NetSuite to align with business needs. Configure settings and workflows. |

| 4. Training and Education | Provide comprehensive training for employees on NetSuite functionalities. |

| 5. Pilot Testing | Conduct tests with a smaller group to identify issues and gather feedback. |

| 6. Full Implementation | Roll out NetSuite across the organization, monitoring closely for any issues. |

| 7. Post-Implementation Evaluation | Review system performance and gather user feedback for improvements. |

| 8. Continuous Support and Upgrades | Maintain communication with support for assistance and stay updated with new features. |

NetSuite Cloud Accounting Software isn’t just a game-changer; it’s a revolution in financial management. At SoftArt, we’ve seen firsthand how this powerhouse transforms businesses. Being trusted NetSuite integration partners, we’re here to help you harness NetSuite’s magic—making your finances streamlined, accurate, and ready to drive your success story.

Let’s discuss how we can help you with financial management effectively. Call us now!

Absolutely! NetSuite caters to businesses of all sizes. Its scalability allows seamless adaptation, making it a viable solution for small to large enterprises.

The time of NetSuite integration services depends on business complexity and customization needs. On average, it might take a few months, but it’s crucial to plan for sufficient time for customization, training, and a smooth transition.

Yes, NetSuite is known for its robust integration capabilities. It can seamlessly integrate with various applications and systems, ensuring a cohesive ecosystem for your business operations.

Absolutely. NetSuite employs top-notch security measures, including encryption and compliance with industry standards, to safeguard your financial data and ensure regulatory compliance.

While having IT expertise can be advantageous, NetSuite’s user-friendly interface and comprehensive training resources make it accessible for users with varying technical backgrounds. SoftArt also provides expert support to guide you through any challenges.

In the dynamic landscape of modern business, the backbone of organizational success lies in the seamless orchestration of operations. Among the pivotal elements driving this efficiency, the choice of an adept Enterprise Resource Planning (ERP) system emerges as a cornerstone, particularly in the realm of financial management. Oracle Netsuite ERP, renowned for its comprehensive suite of tools, presents a compelling solution for businesses seeking to optimize their accounting processes.

Selecting the ideal accounting software within the Netsuite ecosystem is not merely a decision; it’s a strategic investment that can significantly impact a company’s trajectory. As businesses navigate through a labyrinth of options, understanding the nuances of Oracle Netsuite ERP becomes imperative. This blog delves deep into the intricacies of making an informed choice, exploring the key considerations, functionalities, and benefits offered by Netsuite accounting software. With a focus on empowering businesses to align their needs with the right ERP solution, this guide aims to illuminate the path toward selecting the perfect Oracle Netsuite ERP accounting software tailored to unique business requirements.

Oracle Netsuite ERP is renowned for its robustness, versatility, and scalability. Its accounting software module encompasses a wide array of features designed to streamline financial processes, enhance visibility, and facilitate informed decision-making. From core accounting functionalities like general ledger, accounts payable/receivable, to more advanced capabilities including revenue recognition and financial planning, Netsuite caters to businesses across industries and sizes.

The benefits of Oracle Netsuite ERP accounting software are far-reaching, contributing significantly to the operational efficiency, financial accuracy, and strategic decision-making capabilities of businesses:

Comprehensive Financial Management: Netsuite’s accounting software offers a comprehensive suite of financial management tools. It covers core accounting functions such as general ledger, accounts payable and receivable, fixed assets, and bank reconciliation, ensuring accuracy and transparency in financial operations.

Real-time Visibility and Reporting: One of its key strengths lies in providing real-time visibility into financial performance. Advanced reporting and analytics tools enable users to generate detailed reports swiftly, gaining insights that aid in informed decision-making.

Streamlined Business Processes: Netsuite ERP integrates various business processes, eliminating silos and providing a unified platform for operations. It streamlines workflows across departments, enhancing collaboration and efficiency.

Scalability and Adaptability: As businesses grow or evolve, Netsuite ERP scales effortlessly. Its adaptable architecture allows for modifications and customizations to accommodate changing business needs without disrupting operations.

Regulatory Compliance: Staying compliant with industry regulations and accounting standards is crucial. Netsuite’s adherence to global accounting standards ensures businesses remain compliant while operating in diverse regulatory environments.

Enhanced Security: With robust security measures in place, Netsuite ERP offers data encryption, role-based access controls, and regular security updates, ensuring the confidentiality and integrity of financial data.

Cloud-based Accessibility: Being a cloud-based solution, Netsuite ERP offers accessibility from anywhere, at any time, fostering remote work capabilities and facilitating easy collaboration among teams across geographies.

Customer Support and Community: Oracle provides comprehensive customer support, coupled with an active user community. This ensures that users have access to assistance, resources, and updates, facilitating a smoother experience with the software.

Before delving into the selection process, it’s crucial to conduct an in-depth analysis of your business requirements. Identifying pain points, desired features, scalability needs, and budget constraints will serve as a compass in navigating through the myriad of options within Oracle Netsuite ERP.

Each business operates uniquely, and so do their financial processes. While evaluating Netsuite, ensure that the software aligns with your specific accounting needs. Whether it’s multi-currency support, compliance with industry regulations, or advanced financial reporting, comprehensively assess the features offered by Netsuite to ensure they cater to your requirements.

A growing business demands a software solution that can grow alongside it. Consider Netsuite’s scalability and flexibility to accommodate expansion, mergers, or changes in business structure. An ERP system that can adapt to evolving needs without significant disruptions is a valuable asset.

An intuitive and user-friendly interface is pivotal for the successful adoption of any software. Evaluate Netsuite’s user interface to ensure it’s easy to navigate and doesn’t necessitate extensive training for your team.

Robust customer support and a vibrant user community are essential components of a successful ERP implementation. Also, assess the software’s integration capabilities with other tools your business relies on for seamless operations.

In the realm of trusted ERP providers, SoftArt emerges as a notable choice for implementing Oracle Netsuite ERP. Renowned for its expertise, reliability, and commitment to delivering tailored solutions, SoftArt stands as a reliable partner in navigating the complexities of ERP implementation. With a track record of successful deployments and a customer-centric approach, SoftArt ensures a seamless transition to Netsuite, offering comprehensive support at every stage of the implementation process.

The selection of the right Oracle Netsuite ERP accounting software entails a thorough understanding of your business needs, an evaluation of features and functionalities, scalability considerations, user interface assessment, and integration capabilities. As businesses strive for efficiency, agility, and growth, Oracle Netsuite ERP emerges as a robust solution. When choosing an implementation partner, SoftArt stands out as a trusted provider, offering expertise and support essential for a successful ERP implementation journey. Make an informed decision, empower your business, and propel it towards success with Oracle Netsuite ERP.

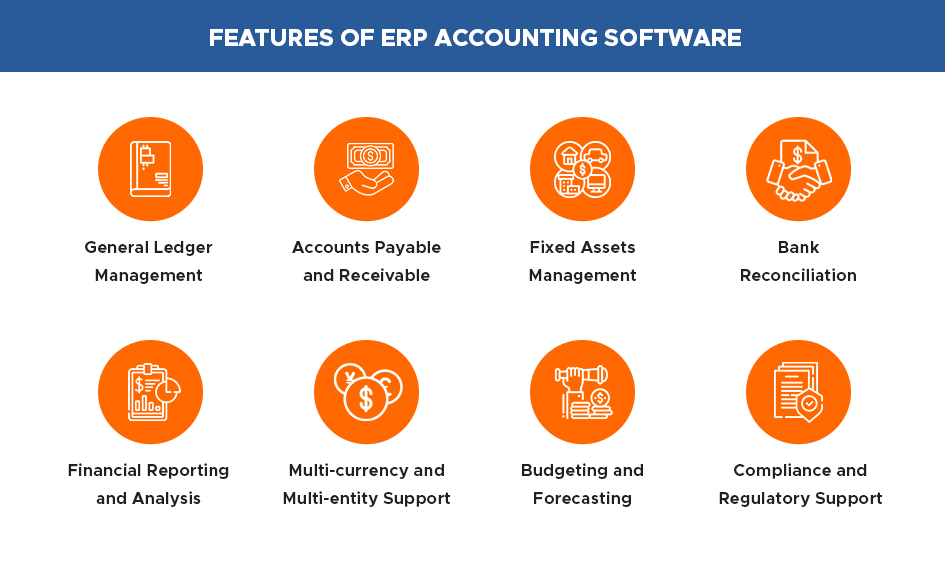

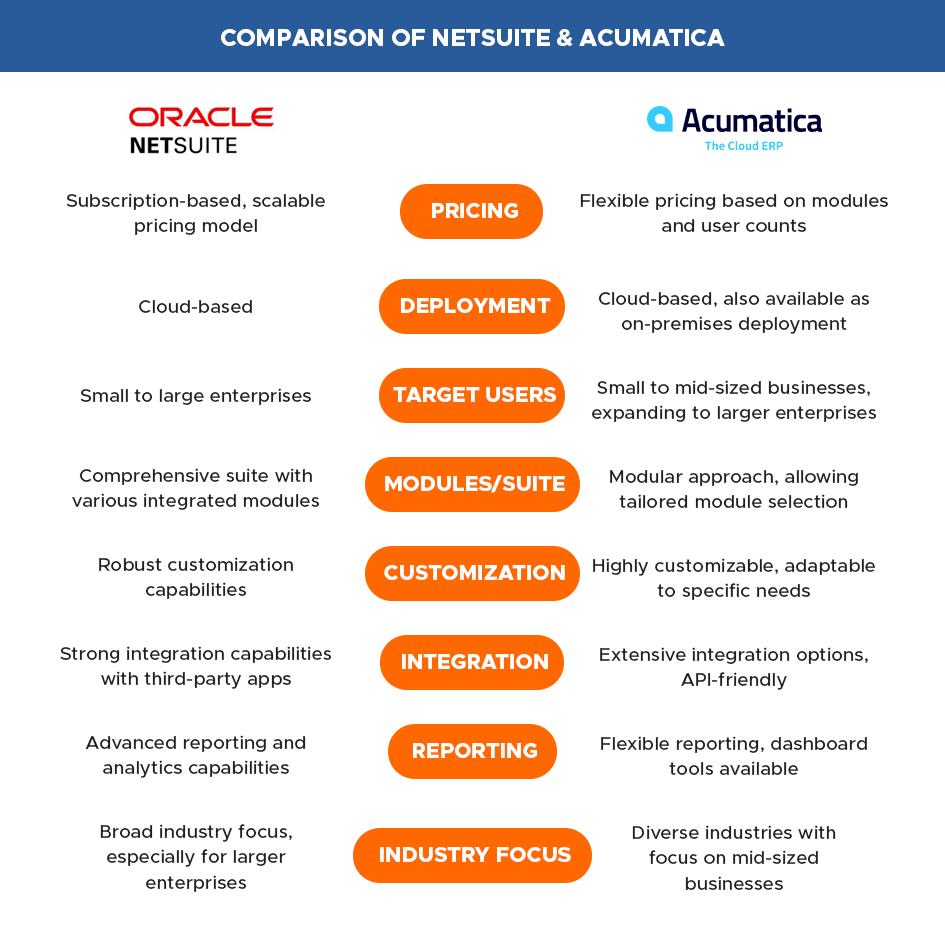

When it comes to choosing an Enterprise Resource Planning (ERP) system for your business, the decision can be overwhelming. Two popular options in the market are NetSuite and Acumatica. Both of these cloud-based ERP solutions offer a wide range of features and capabilities, but they also have distinct differences that make each one suitable for different types of businesses. In this comprehensive guide, we will compare NetSuite and Acumatica, helping you to make an informed decision that aligns with your business needs

NetSuite, now a part of Oracle, is a leading cloud-based ERP solution that offers a comprehensive suite of applications for financials, customer relationship management (CRM), e-commerce, and more. With its robust features and scalability, NetSuite has become a popular choice for businesses of all sizes, from startups to large enterprises. On the other hand, Acumatica is a cloud-based ERP system that is known for its flexibility and adaptability. It is designed to provide a customizable and adaptable platform for businesses to manage their operations effectively.

One of the most critical aspects of choosing an ERP system is evaluating the key features offered by each platform. NetSuite provides a comprehensive set of features, including financial management, revenue recognition, order management, procurement, and inventory management. Its robust CRM capabilities enable businesses to manage their customer relationships effectively, while the e-commerce functionality allows for seamless online transactions. Acumatica, on the other hand, offers a flexible and modular approach to ERP, with features such as financial management, project accounting, distribution management, and customer management.

NetSuite’s extensive feature set makes it a suitable choice for businesses looking for a fully integrated and all-encompassing ERP solution. On the other hand, Acumatica’s modular approach allows businesses to tailor the system to their specific needs, making it an excellent choice for companies with unique or specialized requirements. Whether you prioritize a comprehensive feature set or the flexibility to customize your ERP system, understanding your business’s specific needs will help you determine which platform aligns best with your goals.

When considering an ERP system, it’s essential to evaluate the pricing and scalability of each platform. NetSuite is known for its pricing structure, which is based on a subscription model and includes licensing fees, implementation costs, and ongoing maintenance expenses. While NetSuite’s pricing may be higher upfront, it offers a scalable solution that can accommodate the growth of your business over time. Acumatica also follows a subscription-based pricing model, with the flexibility to choose the modules that align with your business needs. This modular approach allows businesses to start with the essential modules and scale up as their requirements evolve.

Understanding the total cost of ownership and the scalability of each platform is crucial in making an informed decision. NetSuite’s comprehensive suite of applications and scalability make it a suitable choice for businesses looking for a long-term ERP solution that can grow with their business. On the other hand, Acumatica’s modular pricing and flexible deployment options make it an attractive choice for businesses looking for a customizable and scalable Acumatica ERP system.

The user interface and customization capabilities of an ERP system play a significant role in its usability and effectiveness. NetSuite offers a modern and intuitive user interface that is designed to streamline business processes and improve user productivity. Its customizable dashboards and reports allow users to tailor the system to their specific needs, providing a personalized experience for each user. Acumatica also offers a user-friendly interface with customizable dashboards, providing users with the flexibility to access the information they need quickly.

Understanding the level of customization and user interface experience that your business requires is essential in evaluating which platform is the right fit. NetSuite’s modern interface and extensive customization options make it an excellent choice for businesses looking for a user-friendly and tailored ERP system. Acumatica’s flexible interface and customization capabilities make it a suitable choice for businesses looking for a personalized and adaptable ERP solution.

In today’s interconnected business environment, the ability of an ERP system to integrate with other applications and systems is crucial. NetSuite offers robust integration capabilities, allowing businesses to connect their ERP system with third-party applications, e-commerce platforms, and other business systems. Its open API and pre-built connectors make it easy to integrate with a wide range of applications, providing businesses with a seamless and connected ecosystem. Acumatica also provides strong integration capabilities, with the ability to connect with other business applications and systems.

Understanding your business’s integration requirements and the systems you need to connect with is essential in evaluating the integration capabilities of each platform. NetSuite’s extensive integration capabilities and pre-built connectors make it a suitable choice for businesses looking for a connected and interoperable ERP system. Acumatica’s strong integration capabilities and flexible API make it an excellent choice for businesses looking for a customizable and interconnected ERP solution.

Choosing the right ERP system for your business is a significant decision that requires careful consideration of your business needs, goals, and budget. When evaluating NetSuite and Acumatica, it’s essential to assess the key features, pricing, scalability, user interface, customization, and integration capabilities of each platform. Understanding your business’s unique requirements and long-term goals will help you determine which ERP system aligns best with your needs.

If your business prioritizes a comprehensive and all-encompassing ERP solution with robust features and scalability, NetSuite may be the right choice for you. On the other hand, if your business requires a flexible and customizable ERP system that can adapt to your specific needs, Acumatica may be the ideal fit. Ultimately, the decision between NetSuite and Acumatica depends on your business’s individual requirements, and making an informed decision will ensure that you choose the right ERP system that supports your business growth and success

As you navigate the decision-making process of choosing the right ERP system for your business, SoftArt is here to help. Our team of experts specializes in ERP consulting and implementation, guiding businesses through the selection and deployment of ERP solutions that align with their unique needs. Whether you are considering NetSuite or Acumatica, SoftArt can provide the expertise and support you need to make an informed decision and ensure a successful ERP implementation. Get in touch with us today to learn more about how we can help you choose the right ERP system for your business.

Imagine the power of having all your business processes – from financial management to customer relationship management, from order management to human capital management – all working seamlessly under one cloud-based platform. Yes, that’s what Oracle NetSuite ERP (Enterprise Resource Planning) brings to the table. This comprehensive, scalable suite of applications is a game-changer in how businesses operate, streamlining processes and providing real-time visibility across the entire organization.

As a premier cloud ERP solution, Oracle NetSuite provides a unified platform that aligns your business processes with your corporate goals. It does away with the need for disparate systems and provides a single source of truth for your business data. This means increased efficiency, improved decision-making, and enhanced collaboration across departments.

For you, as a business leader, Oracle NetSuite ERP provides the tools to drive growth, reduce IT costs, and enable a flexible, agile organization that can quickly respond to changing market conditions. It’s not just an ERP system; it’s a transformational business solution that brings about a paradigm shift in how you manage your business.

Chances are, if you’re running a business, you understand the critical role financial management plays. It’s the backbone of your organization, affecting every aspect of operations – from budgeting and cost control to cash flow management and investment decisions. Financial management is not just about keeping track of income and expenses; it’s about strategic planning, risk management, and ensuring your business’ financial health.

In today’s fast-paced, competitive business environment, financial management is more important than ever. It provides the foundation for informed decision-making, offering insights into the financial implications of business strategies. It’s about ensuring profitability while managing risks. Essentially, effective financial management is key to sustainable business growth.

However, managing finances is not without its challenges. Traditional methods of financial management, often characterized by manual processes and disconnected systems, can be time-consuming and error-prone. This is where financial management with Oracle NetSuite ERP comes into play, offering a more streamlined, efficient approach to managing your business’ finances.

NetSuite financial management brings unprecedented efficiency and accuracy. The first way it does this is by automating routine tasks. Think about the time-consuming processes involved in financial management – from invoicing and expense tracking to financial reporting and forecasting. Oracle NetSuite ERP automates these tasks, freeing up your time to focus on strategic decision-making.

In addition, Oracle NetSuite ERP provides a single, integrated platform for financial management. This means no more juggling between different systems for accounting, budgeting, and financial reporting. With Oracle NetSuite ERP, you have a unified view of your financial data, enabling faster, more informed decisions.

More importantly, Oracle NetSuite ERP allows for real-time financial management. With traditional methods, financial data is often outdated by the time it’s used for decision-making. With Oracle NetSuite ERP, you have access to real-time financial data, allowing for immediate action and proactive management.

NetSuite’s financial management suite is packed with features designed to streamline the financial management process.

General Ledger: Real-time visibility into financial data with support for multi-currency transactions and automated allocation processes.

Accounts Payable (AP): End-to-end automation for invoice processing, approval workflows, and payment disbursements.

Accounts Receivable (AR): Efficient management of invoicing, collections, and cash application processes.

Financial Reporting: Customizable reports and dashboards for real-time insights and informed decision-making.

Multi-Currency Management: Automatic currency conversion and accurate global financial reporting.

Financial Planning and Budgeting: Integrated tools for creating, monitoring, and adjusting budgets and forecasts.

Fixed Assets Management: Lifecycle management from acquisition to disposal, ensuring compliance.

Expense Management: Streamlined employee expense reporting, approval workflows, and reimbursement.

Revenue Recognition: Automation to manage complex revenue recognition processes and compliance.

Audit and Compliance: Built-in controls, audit trails, and support for financial regulations.

Integration with Other Modules: Seamless connectivity with inventory, orders, CRM, and more.

Automation and Workflows: Customizable workflows to reduce manual intervention and errors.

The benefits of streamlining financial management with Oracle NetSuite ERP are manifold.

Streamlining financial management with Oracle NetSuite ERP benefits leads to streamlined processes, reducing manual data entry and repetitive tasks, thus freeing up valuable time for finance teams to focus on more strategic activities.

NetSuite provides real-time visibility into financial data, enabling quick access to accurate information for informed decision-making. This empowers businesses to respond promptly to market changes and make agile financial strategies.

Automation and standardized workflows within NetSuite ERP minimize the risk of human errors associated with manual data handling, ensuring precise financial records and compliance with accounting standards.

By automating processes like accounts payable and receivable, budgeting, and expense management, organizations can allocate their resources more effectively, reducing operational costs and improving overall financial health.

NetSuite’s built-in controls and audit trails enhance compliance with financial regulations and data security requirements. This safeguards sensitive financial information and minimizes the potential for fraud.

As businesses expand, NetSuite ERP scales seamlessly to accommodate increased financial complexities and volumes. Its integrated approach ensures that financial processes remain cohesive and efficient, supporting sustainable growth.

As businesses increasingly embrace digital transformation, Oracle NetSuite ERP is at the forefront, providing a comprehensive, efficient, and scalable solution for financial management.

With Oracle NetSuite ERP, businesses can move away from traditional, disjointed systems towards a unified, cloud-based platform that streamlines processes and provides real-time visibility into financial data. It’s not just about managing finances; it’s about driving business growth and staying ahead in a competitive market.

SoftArt can offer cloud financials, CRM, ecommerce, HCM and professional services automation management for all organizations from fast-growing midsize companies to large global organizations. Having an experience of two decades, SoftArt can help you in making the right decisions and a smooth Oracle netsuite integration.

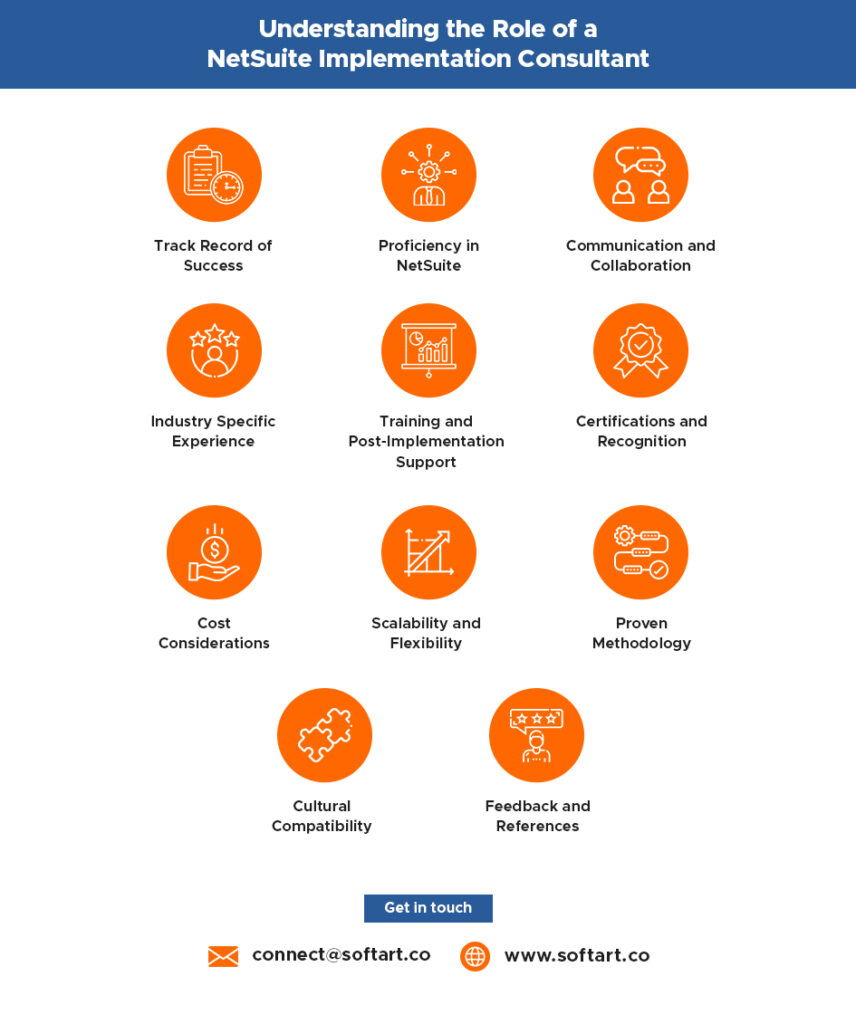

NetSuite implementation comes with many advantages for the companies, including streamlined processes, increased efficiency, and a clear picture of their business environment. The path to a successful NetSuite adoption may be difficult and comes with challenges. So, here comes the role of a NetSuite implementation consultant. Let’s discuss the importance of choosing the ideal NetSuite Implementation Consultant to lead this journey of success and figure out the major factors to choose right NetSuite.

This article covers the vital elements to consider when identifying the best NetSuite Implementation Consultant to achieve a seamless and effective migration to NetSuite. These aspects will assist you in avoiding typical errors and making the most of NetSuite’s powerful features.

Determining what a NetSuite Implementation Consultant brings is crucial before diving into the selection parameters. These consultants have expertise in the many features NetSuite offers and can assist companies in customising the platform to meet their specific requirements.

A NetSuite implementation consultant’s responsibilities go beyond simple technical knowledge. They act as businesses’ strategic partners, helping them through every step of the problematic NetSuite implementation process, from pre-implementation planning to post-implementation assistance. Their services usually include system configuration, data migration, integration with existing systems, customisation, user training, and ongoing support.

An essential qualification for a NetSuite Implementation Consultant is experience. According to their track record, they have effectively weathered the difficulties of NetSuite deployment in the past. Look for a consultant with a strong track record of successfully implementing NetSuite, ideally in your sector.

Examining case studies, client recommendations, and independent reviews can give you information about a consultant’s success rate. The study will open a window into their implementation strategy, capacity for timely and cost-effective delivery, and dedication to client pleasure.

Expertise with NetSuite is a crucial factor to consider when choosing a NetSuite Implementation Consultant. Their technical knowledge should cover the whole range of NetSuite’s features, and they should be knowledgeable about the most recent developments in the platform.

The consultant should also be well-versed in matching NetSuite’s extensive features with your unique business requirements. This entails modifying the platform to meet your operational environment and utilising its features to boost production and efficiency.

An efficient NetSuite deployment relies on strong collaboration and communication. Select a consultant who believes in timely, honest interaction. They should keep you updated on the project’s development, obstacles, and adjustments to its timeframe or scope.

Collaboration is also essential. The ideal consultant will collaborate closely with your internal team to ensure your company’s needs and goals drive every choice. They should also be receptive to criticism and ready to make changes in response to suggestions from your team.

Although NetSuite is a flexible platform that serves a variety of businesses, each one has its unique dynamics, legal needs, and operational difficulties. The ideal NetSuite Implementation Consultant should be well-versed in your sector’s requirements.

A consultant knowledgeable in your field can provide insightful advice on best practices, potential roadblocks, and workable business plans. Additionally, they can modify NetSuite’s setups to conform to your sector’s operating plans and legal needs.

The system’s official release is only the beginning of a successful NetSuite implementation. Gaining all of the advantages of the platform depends on user adoption. The competent consultant should offer in-depth user training to ensure that your staff can utilise NetSuite efficiently.

Additionally, post-implementation support is essential for resolving any problems after going live. The consultant should assist with system optimisation, user questions, and upgrades and improvements.

A consultant’s knowledge of NetSuite is confirmed through certifications. Seek out advisors who have earned reputable NetSuite certifications, which attest to their proficiency in various platform-related areas like administration, ERP consulting, SuiteCloud development, and more.

Another excellent sign of a consultant’s competence and dependability is recognition by NetSuite itself, such as being an authorised NetSuite Solutions Provider.

Although price shouldn’t be the only criterion, it should be considered when selecting a NetSuite Implementation Consultant. You may plan your budget more effectively if you know the consultant’s pricing for services, including consulting, data migration, customisations, and integrations.

Also, take into account the price of continuous upkeep and support. In the long term, a consultant who provides a thorough, affordable assistance package is beneficial.

Your NetSuite system needs to scale and adapt as your business grows. It’s critical to select a consultant who can aid in the expansion and transformation of your company. As your company’s demands evolve, they must be able to modify system settings, add new modules, or integrate new apps.

The consultant’s implementation strategy might reveal information about how they operate and how effective they are. A tried-and-true approach ensures that all crucial implementation factors are covered, lowering the possibility of oversights or errors.

The success of a NetSuite implementation can also be strongly impacted by cultural compatibility. Select a consultant whose business culture is compatible with yours. This could promote good communication and make the implementation process go more smoothly.

The power of word of mouth has changed nowadays. The internet provides an array of information; we are no longer constrained to asking our neighbours or friends for recommendations. It is crucial to thoroughly research a NetSuite Implementation Consultant’s reviews and references before hiring them.

Thanks to Netsuite accounting services, businesses can view their financial success in real-time. Companies may get a complete picture of their financial situation and make data-driven decisions using tools like automated financial reporting, configurable dashboards, and advanced analytics. Additionally, the cloud-based Netsuite platform makes it simple to collaborate and access financial data at any time, anywhere. In general, Netsuite accounting services aid companies in streamlining their financial operations and enhancing productivity and profitability.

The success of your company’s NetSuite implementation depends heavily on your choice of NetSuite implementation consultant. Consider these factors to choose right NetSuite included in this article and implement it successfully to take the advantages. Remember that the ideal consultant is a strategic partner in your company’s journey towards operational excellence and not just a service provider.

We hope this manual serves as a road map for you as you proceed through the selection procedure. Do your homework, ask the correct questions, and choose what will best serve your company’s needs and goals without rushing the decision.

1. Why is industry-specific knowledge important for a NetSuite consultant?

Ans. Industry-specific expertise makes that the consultant is aware of your company’s specific issues, regulatory quirks, and market trends. This expertise can result in a smoother installation process, custom solutions, and a system that is adapted to the requirements of your sector.

2. What should I expect in terms of post-implementation support?

Ans. Technical solutions, regular upgrades, team training sessions, and ensuring the system stays tuned to your changing needs are all examples of post-implementation support. The scope and length of this help must be made clear in your agreement.

3. How can I verify a consultant’s experience and track record?

Ans. In addition to the consultant’s claims, you should confirm their expertise by looking up internet reviews, obtaining case studies, requesting client references, and getting client testimonials. Speaking with former customers and looking at their finished projects can provide a thorough understanding of their experience.

4. Are online reviews reliable when gauging a consultant’s effectiveness?

Ans. Online reviews offer insightful information, but it’s important to approach them with caution. Analyse the feedback for trends and take into account the volume of reviews. Keep in mind that occasional unfavourable comments might be anomalies, but regular comments—whether positive or negative—are important to pay attention to.

5. How can case studies help in evaluating a consultant?

Ans. Case studies provide an in-depth review of how a consultant approaches actual problems. They emphasise the consultant’s capacity for problem-solving, strategic thinking, and the concrete outcomes attained for clients. In essence, they serve as a real-world demonstration of the consultant’s abilities and knowledge.